There are two types of people in the world, those who can remember the answer to a question, and those who can’t.

For a variety of reasons, a lot of people aren’t good at this whole financial stuff. To be honest, I think that’s one of the main reasons that we keep talking about “The Millionaire Mind.” For some reason, it seems that people who’ve built a lot of wealth think that they are smarter than those of us who are just trying to make ends meet.

Sure, it might be that we dont like being told that we are smarter than others, but it seems that it is a major factor in why so many people are so focused on money. The truth is, we arent as smart as everyone thinks we are. We just don’t really know what we are doing. If we just tried to think about it like we are thinking about something else, we would be amazed.

I know that people who go on and on about their own intelligence seem to be a bit of a pain in the ass, so I don’t blame them. But I think that we should all be careful about making the assumption that we are smarter than everyone else.

A good example of our “intelligence” comes from the stock market. The stock market is one of the most accurate indicators of the general economic health of any given market. In 2000, the S&P 500 was trading at a market capitalization of around $5.6 trillion. A year later it had doubled to $40.8 trillion.

Well, it’s not the same market, but it’s close. There are two different markets. The SampP 500 was a single market that grew from a very small start to a very large one, and its value has increased with each year, despite no longer being the most liquid market in the world. In 2000, the SampP 500 was trading at 5.6 trillion. In 2010 it had grown to 40.8 trillion.

The SampP 500 is now valued at 40.8 trillion. When people talk about the markets they mean a single market that has grown from a very small start to a very large one. Most people would agree with this, but there is a second market that is growing at about the same pace. This second market is called Clemson Finance. One of its largest investors, Warren Buffet, has now poured over $4.

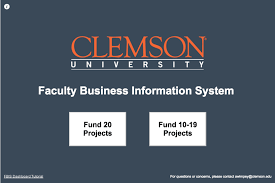

Clemson Finance is an investment company that is headquartered in the town of Clemson, South Carolina. It has an ownership of about 11% of Clemson Finance. The company was founded by Warren Buffet in 1998. Clemson Finance was the second largest investment company in the United States and the most profitable.

I think there are a lot of people who are confused as to whether the money is going to Clemson Finance or Clemson Finance and they don’t see the difference.

The main reason for this is that the bank does not want to be known as a ‘big bank’, but they dont want it to be known as a ‘big money’. It is probably because they dont want to be known as big money, but they dont want to be known as a big money.